Last week saw strong gains with the equity markets setting their first record high of the new year. Trading was shortened due to MLK day on Monday, which happened to coincide with Inauguration Day. President Trump’s second (non-consecutive) term was off to fast start with signing a slew of executive orders, many reversing actions taken by the previous administrations. Despite prior announcements, no (new) tariffs have been announced. Notably, however, is the POTUS calling for lower interest rates not just in the US but globally during an appearance at the World Economic Forum. Since better than expected inflation data in the US, yields have been retracing (albeit rebounding somewhat since the beginning of last week, with the 10-yr treasury yield closing just above 4.6% on Friday) and off the highs of 4.89% and 5.16% on the 10- and 30-year treasury, respectively set on the 13th of January.

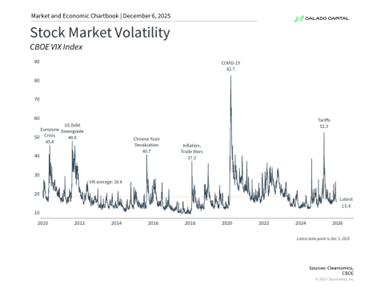

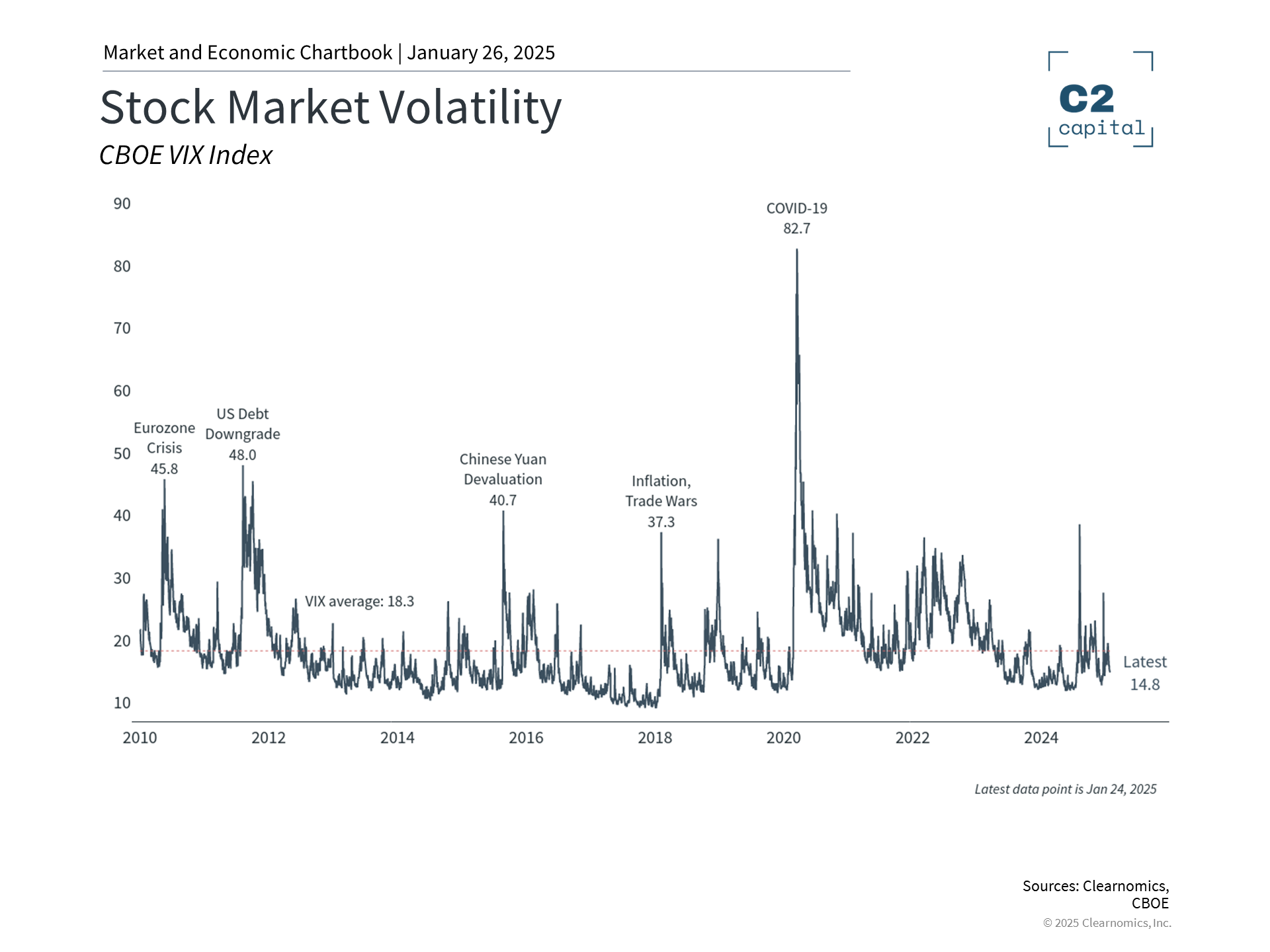

For the week, both the Nasdaq and S&P500 closed 1.7% higher, respectively, while the Dow Jones finished the week up 2.2%. CBOE Volatility (VIX) eased further, closing below 15. All sectors closed higher in the week, except for energy, which was down 2.5% for the week after rallying during the previous weeks. Worldwide saw equity markets advance for the week as well, except again for India (down 0.6% for the week).

Monetary policy will take center stage in the US, with the Fed’s FOMC meeting scheduled for this Tuesday and Wednesday. Market expectations are for rates to remain unchanged, and focus will quickly turn to the Fed’s projections for the remainder of the year. Previously, Fed meeting minutes have disclosed that opinions of FOMC members as to the future course of monetary policy are diverging.

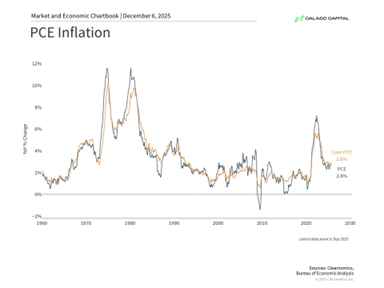

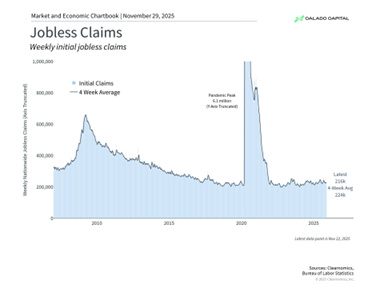

Besides the Fed’s meeting, macro data on the calendar are an update on US GDP on Thursday, and the Fed’s favorite inflation gauge the core personal consumption expenditures (PCE) on Friday; hence AFTER the Fed’s FOMC meeting. Beforehand, markets will see reports on new home sales for December on Monday and durable goods orders on Tuesday, and an update to weekly jobless claims on Thursday to provide an update on the labor market.

As if the macroeconomic calendar was not enough, the earnings season will continue with many large cap’s scheduled to report, including four (4) or Magnificent-7, or Apple, Microsoft, Meta and Tesla among others. The earnings season has been off to a great start with financials reporting better than expected results previously, and Netflix elevating the positive sentiment to earnings last week with a blow-out quarter.

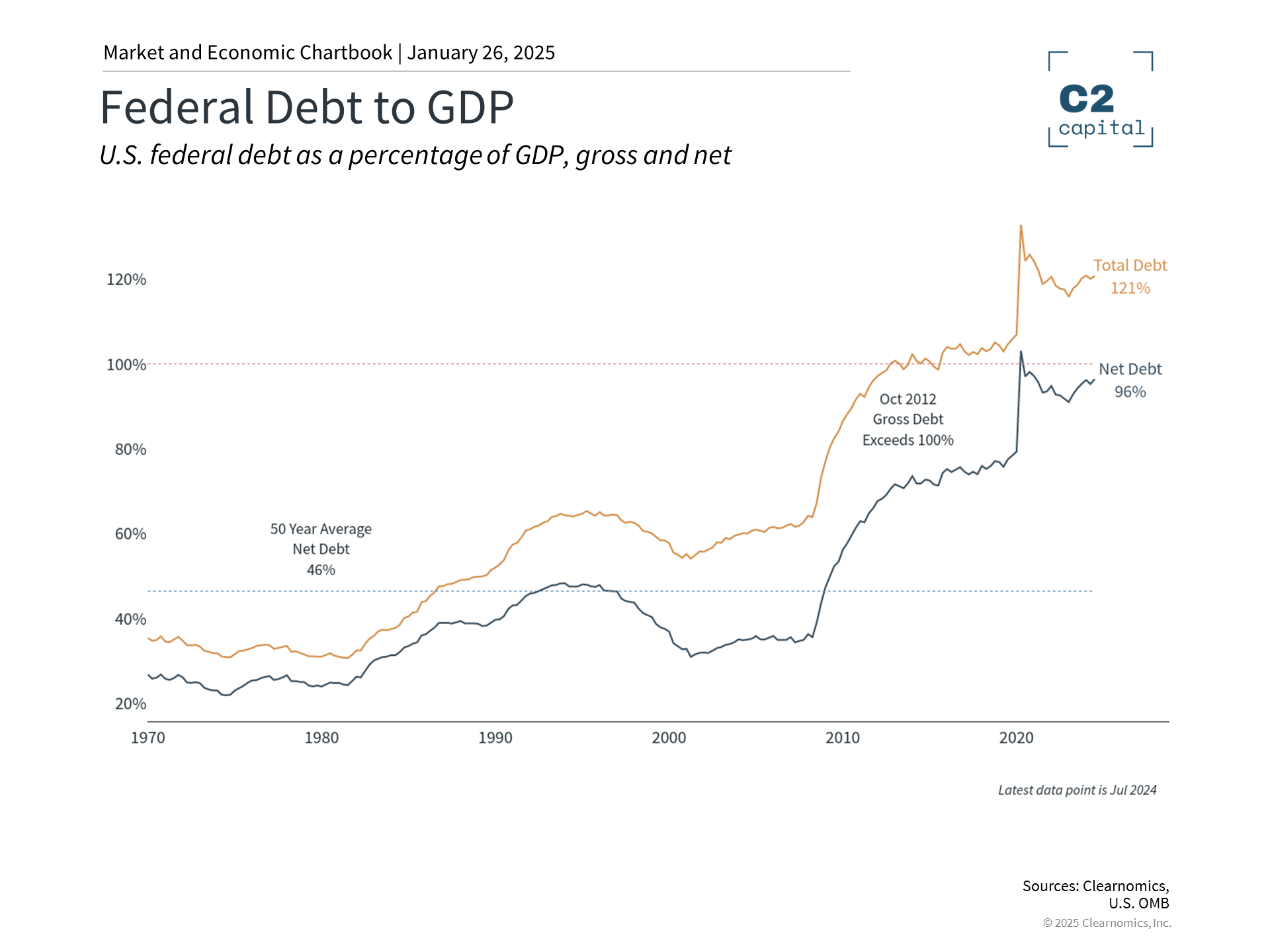

Focus on the US debt will resume with discussions being held on extending the tax cuts from President Trump’s first term also in lieu of the reinstatement of the debt ceiling on Jan. 2nd, 2025. The previous Secretary of the Treasury, Yellen, had announced at the beginning of the month it would have to take extraordinary measures to comply with it. Further, POTUS appears compelled to keep its campaign promises (including eliminating taxes on tips and overtime). Besides, expect discussions or references to tariffs to influence volatility of equities that may be impacted by it. As such, with the FOMC announcing monetary policy on Wednesday, expect yields to move later in the week.

Finally, I expect volatility to heighten in the equity markets as well as participants will look to absorb all this information. Also, expect discussions or references to tariffs to influence volatility of equities that may be impacted by it.

Latest Newsletter

Week in review and ahead (vol.49)

marketing@caladocapital.com2025-12-06T21:55:55+00:00December 6, 2025|

Week in review and ahead (vol.48)

marketing@caladocapital.com2025-11-29T23:35:08+00:00November 29, 2025|

Week in review and ahead (vol.47)

marketing@caladocapital.com2025-11-22T23:56:30+00:00November 22, 2025|