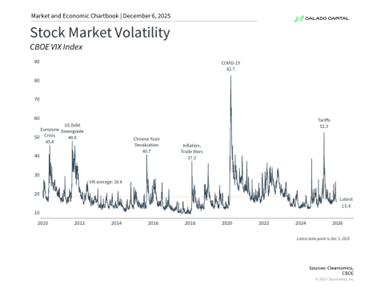

The week before last, markets started selling off on news of DeepSeek R1. Last week started similarly, with markets selling off on Monday on news the US was imposing tariffs on Canada and Mexico (of 25%, and 10% on oil and gas products), and China (of 10%). In both cases, markets recovered somewhat avoiding deeper selloffs. The threats from both, however, are not gone and continue to weigh on sentiment. That said, news the US President is considering imposing reciprocal tariffs on anyone triggered yet another selloff on Friday to close out the week.

While tariffs on Canada and Mexico have been postponed by thirty (30) days, tariffs for China did go in effect as did (somewhat tampered) retaliatory measures by China. The threat of escalating trade war(s) looms, and sectors that may be impacted by it show weakness and selling pressures. For example, the automotive OEM sector in the US saw declines (with the exception for Lucid bucking the trend being up 2.54% for the week), led by Tesla (down 10.62%) and Ford (down 8.33%). Despite reporting better than expected quarterly earnings last week, Ford’s price action reflected the weaker guidance and noted risks from tariffs. As such, within the S&P500 sector map, industrials and materials declined 0.8% and 0.6%, respectively, for the week but consumer discretionary saw a steeper weekly decline of 3.6% that may have been impacted by quarterly earnings, but more so on weak outlook and risk of tariffs.

The earnings season continued in high gears last week and generally strong revenue, earnings growth and forward guidance was key for the market’s rebound after the selloff on Monday. In general, so far over 75% of the companies in the S&P reporting were able to exceed both revenue and earnings expectations. The market’s rebound was notable despite two of the Mag-7, Google, and Amazon, as well as chipmaker AMD, reports failed to impress investors and saw their stock prices retreat, even though they beat on revenue and earnings expectations for the quarter. The implications of DeepSeek’s R1 a new raised questions on the continued increase of capital spending by hyperscale’s like Google and for chipmakers’ AI revenue going forward. NVDIA is yet to report and will garner much attention when it does in late February.

For the week, and despite the selloffs beginning and ending the week, major US indices showed minor declines for the week, with the S&P500 down 0.2%, the Nasdaq and Dow Jones declining 0.5%. Globally, major indices ended higher for the week except for Japan. China and Hong Kong’s indices were up 1.6% and 4.5%, respectively, as hopes for stimulus re-emerges (and despite US tariffs).

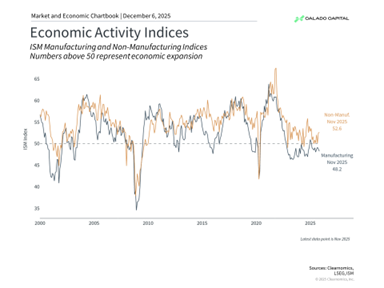

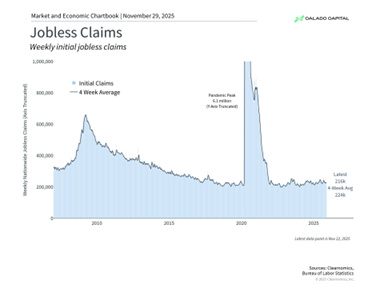

On the macroeconomic side, focus was squarely on the labor market, surprising markets. First, reports of job openings in the US (JOLTS) came unexpectedly lower, with 7.6M openings reported compared to 8.2M previously, and 8M expected. US productivity for the 4th quarter of 2024 came in at 1.2% compared to expectations of 1.4%, and 2.3% reported for the previous quarter, while weekly jobless claims were higher than expected at 219,000, albeit slightly by 5,000.

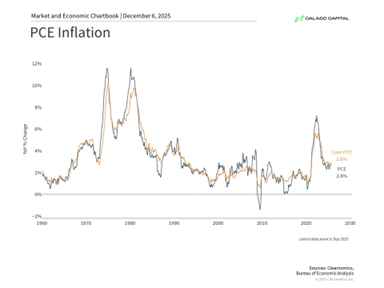

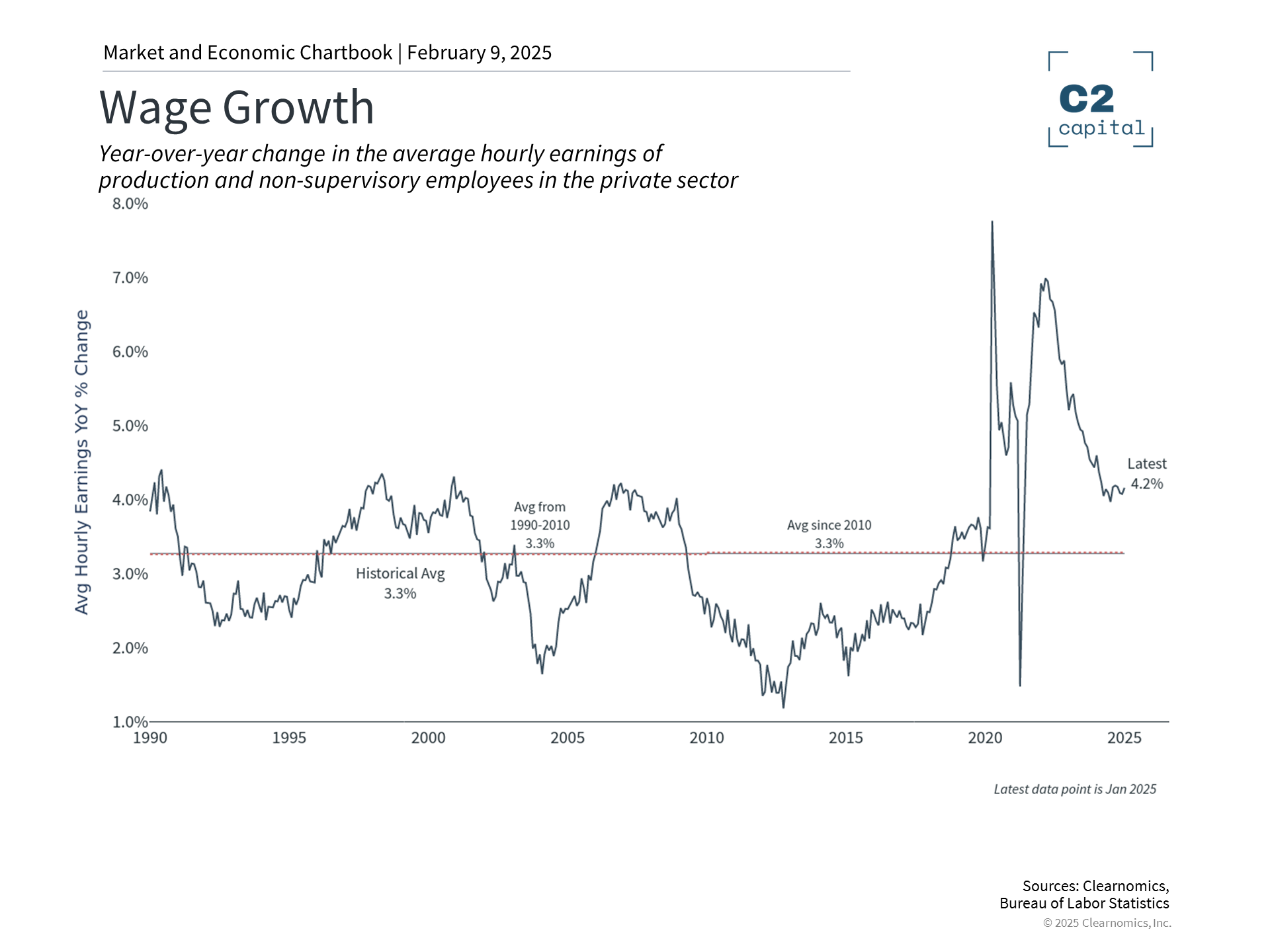

The week concluded with job numbers for January (of 143,000) coming in well below expectations (of 169,000), all the while unemployment rate unexpectedly ticked lower to 4% from 4.1%. Wage growth, however, created maybe the biggest surprise, demonstrating that inflation risks remain for the US. Hourly earnings rose 0.5% month-over-month (‘MoM’), well exceeding the expected and prior MoM rate of 0.3%. From a year-over-year perspective, wage growth in January was 4.2% compared to an expected YoY rate of 3.7%, and higher than the 4% YoY rate reported in December.

Besides the labor market reports elevating re-inflation fears and raising doubts the Fed may continue cutting rates this year, the University Michigan’s sentiment index added to it. While consumer sentiment declined more than expected for the second consecutive month, inflation expectations (by US consumers) for the year increased to 4.3% in February. The increased expectations in inflation for February were a full 100 basis points higher than reported just last month and the highest level since November 2023.

Not much attention and/or reaction garnered the report on the US trade deficit for the month of December on Wednesday, which was the second highest on recent record, with a deficit of nearly $100B. This was significantly higher than reported previously and may have been affected seasonally, the timing of Chinese New Year, but also looming tariff threats, with many (elevating imports) trying to get ahead of it. It can be expected that markets will focus more closely on this metric going forward.

Next week’s macroeconomic data will focus on inflation with reports due on January’s retail (CPI) and wholesale (PPI) inflation and conclude with a reading on US’ consumer with retail sales due on Friday.

Fed chair Powell is scheduled to testify to congress on Tuesday and Wednesday. Given recent remarks by newly appointed Treasury Secretary Scott Bessent that long-term rates may be more in focus than short-term (during this administration under President Trump) and not focusing on the Fed’s independence, Powell’s testimony may be less contentious than one may have otherwise assumed. That said, markets will follow it closely, particularly given recently reported unfavorable data points on inflation and tariff risks

The corporate earnings season continues next week with more than 500 companies in all due to report and adding to the scorecard for this quarter. So far, earnings reports continue to cement continued growth, with FactSet analysts expecting earnings to grow 8.7% and 10.2% for the first and second quarter of 2025, respectively, and a solid 13% for 2025 and which should underpin elevated valuations in the US.

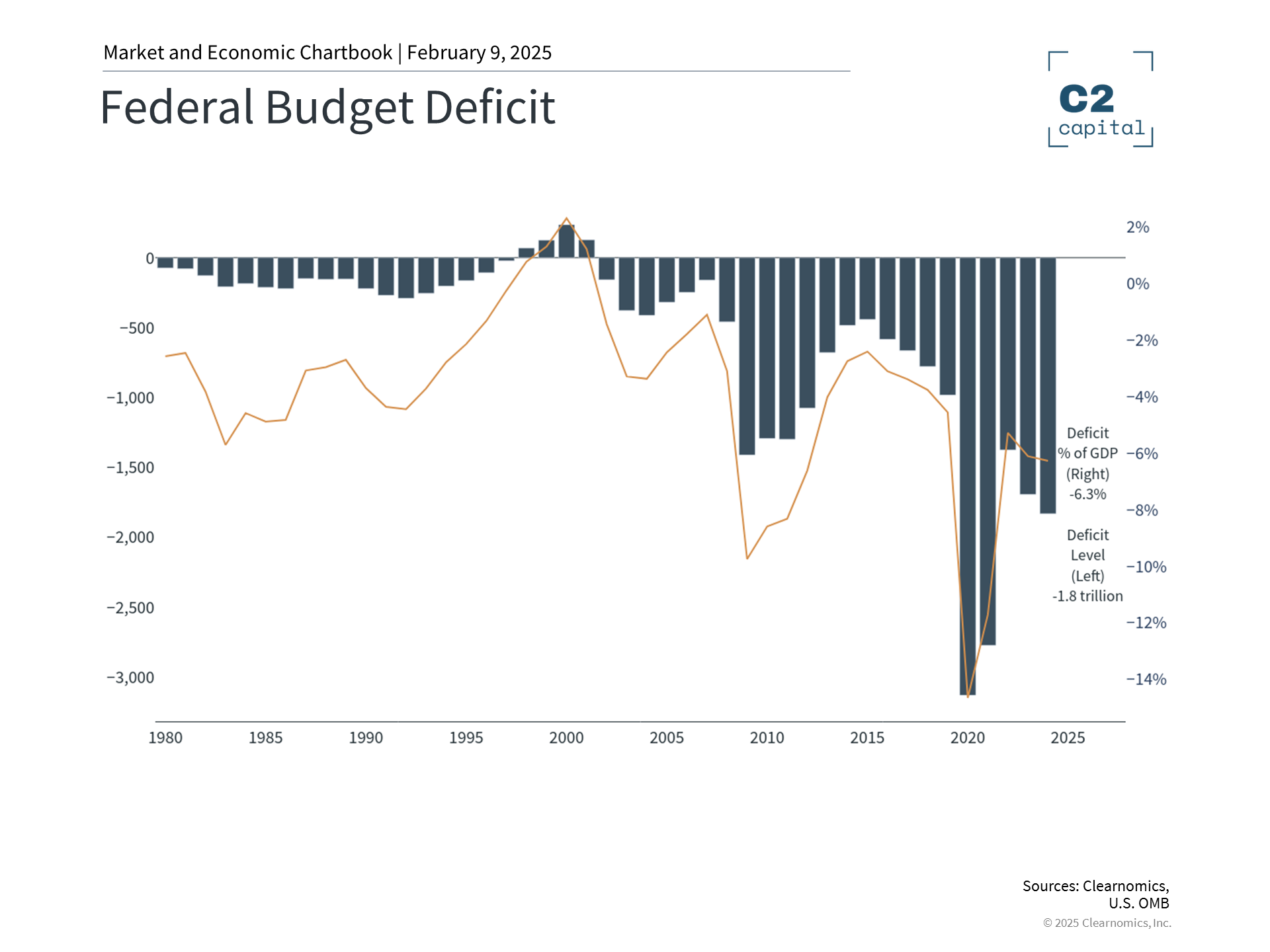

Finally, look for the report on the US’ monthly federal budget for January due on Wednesday. Given enhanced scrutiny on governmental spending and ongoing attempts to cut spending aggressively to rein in debt, but also for tariffs to raise “external” revenue funds, I expect this report, similarly to US trade balance, to garner more focus under this administration. In December, the US monthly federal budget was reported at -$22B.

Latest Newsletter

Week in review and ahead (vol.49)

marketing@caladocapital.com2025-12-06T21:55:55+00:00December 6, 2025|

Week in review and ahead (vol.48)

marketing@caladocapital.com2025-11-29T23:35:08+00:00November 29, 2025|

Week in review and ahead (vol.47)

marketing@caladocapital.com2025-11-22T23:56:30+00:00November 22, 2025|