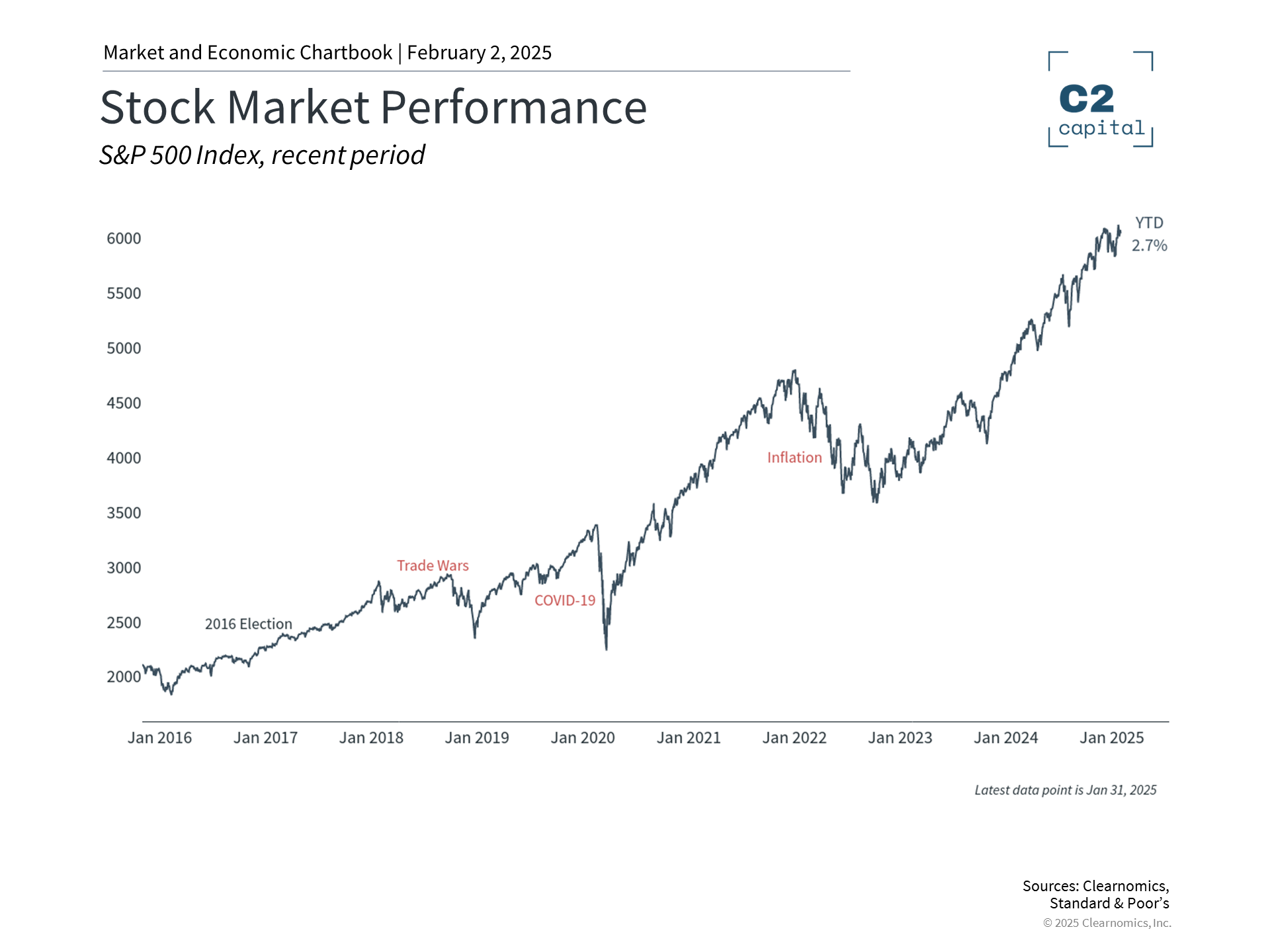

DeepSeek’s R1 AI model impacted world markets, like no other [AI] model, app, or technology, by triggering a steep selloff to start the trading week. Despite introducing itself to the world on December 26th, 2024 (DeepSeek-V3), the release of the R1 model roiled markets like no other, particularly the tech sector. While the performance of the R1 model impressed, claims by the Chinese startup it was able to achieve it with minimal costs stands in stark contrast to the billions of dollars being spend elsewhere, hence, directing focus to the valuations of [AI] tech companies. A simple tweet by billionaire Marc Andreessen on Sunday reflected this best acknowledging R1’s introduction was “AI’s Sputnik” moment. As such, the S&P tech sector was the sole one to end the month lower by nearly 3%, with other sectors advancing at least 1.7% (real estate) and as much as nearly 9% (communications).

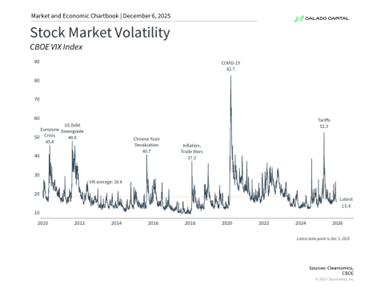

Regardless of the claims by DeepSeek, the selloff to begin the week, and subsequent recovery throughout the week, demonstrates heightened volatility in the markets and that selloffs are happening more frequently (this being the fourth (4th) in six (6) months). The elevated valuations of US equities will see continued challenges on headlines alone. Investors seem not willing to understand or analyze context [of headlines] but instead prefer to do so after selling (hence, the idiom, “shoot first, ask questions later”).

Despite the selloff at the beginning of the week, markets found a way to recover, helping the S&P500 close out the month, advancing 2.93%. This may bode well for the remainder of the year if the January effect (“as goes January so goes the year”) holds true. Both the tech-heavy Nasdaq Composite and the Dow Jones advanced, too, ending the month up 1.8% and 5.1%, respectively.

For the week, however, the S&P500 and Nasdaq Composite declined 1% and 1.6%, respectively, while the Dow managed to advance slightly by 0.3%. Besides DeepSeek R1’s impact from which markets were recovering towards the weekend, news mid-day Friday that the US will impose tariffs on Canada, Mexico (of 25%) and China (of 10%) beginning February 1st, triggered anew a selloff in the late hours, exacerbating the negative sentiment in the markets.

The recovery in markets, despite the negative sentiment, was helped in part by a large number of companies generally reporting better than expected quarterly earnings across all sectors, including semiconductors that were hit strongest by the selloff this past Monday. Focusing on tech, analysts were able to take advantage of inquiring about the implications from DeepSeek’s R1 model on their respective business plans, including from a few of the Mag-7 (namely Apple, Microsoft, Meta, and Tesla) that reported better results, except for Tesla. Guidance provided for the quarter ahead, however, was somewhat mixed, except again Tesla, which promised the launch of its Robotaxis by June. Company earnings reports will continue this upcoming week, with over five hundred (500) Companies reporting, including Google and Amazon, while the much-anticipated report by the last of the Mag-7, NVDA will not be due until the end of February.

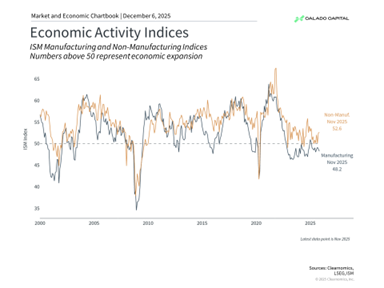

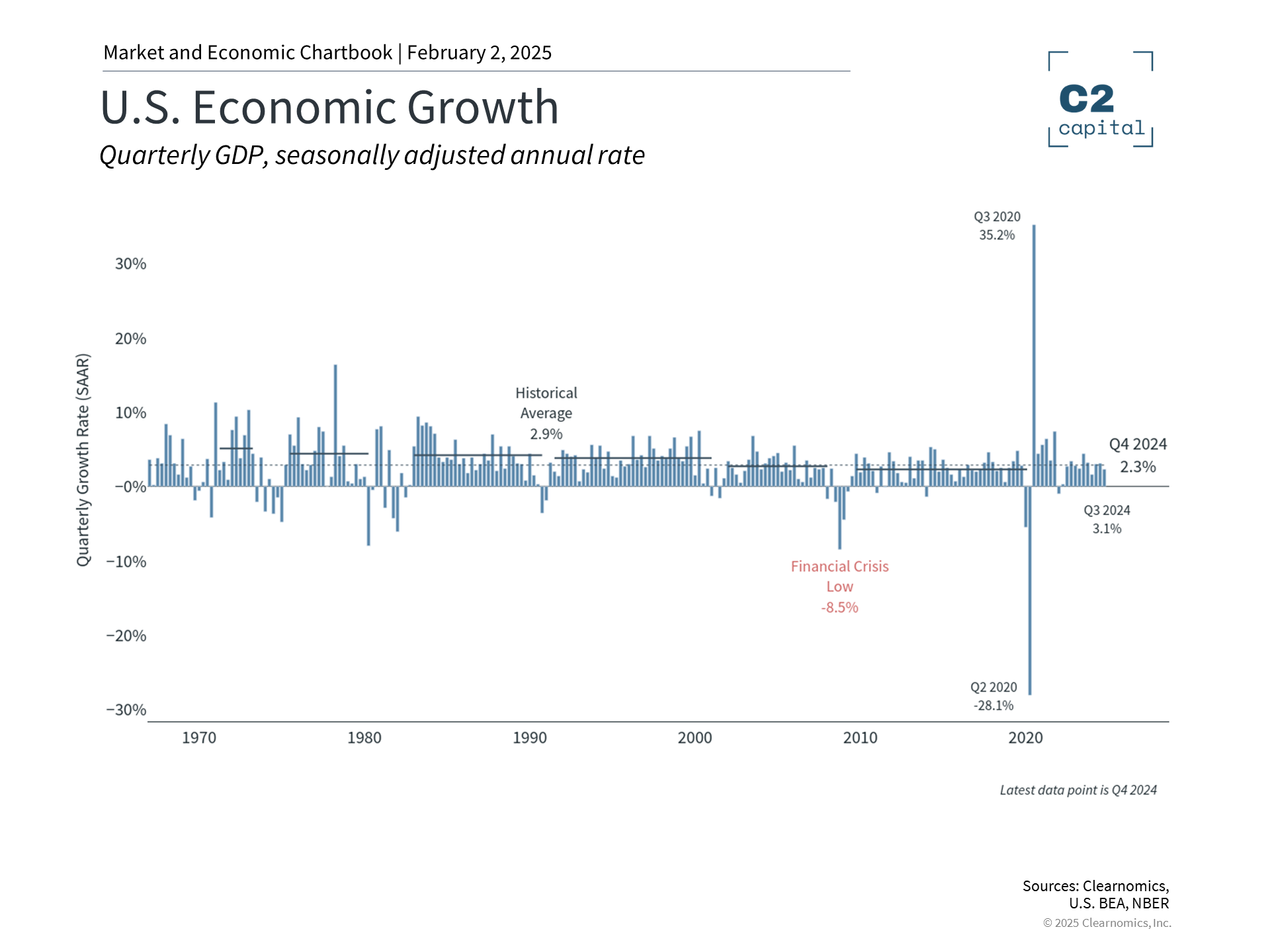

On the macroeconomic front, US GDP for the 4th quarter grew 2.3%, less than the expected 2.5%. This was the first read and may be revised but showed consumption up significantly (4.2% inside of GDP – best since Q1’23) and prices paid lower than expected (2.2% vs 2.4%), nevertheless sequentially higher than previously of 1.9% in Q3. Increased spending (by both consumer and government), higher net exports (due to lower imports) offset lower investments in the quarter.

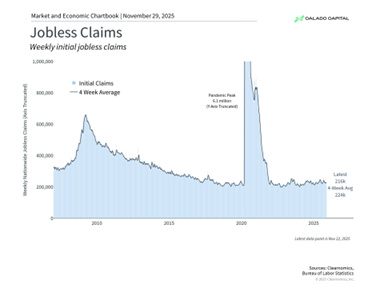

Jobless claims for the week were better than expected, showing some resilience of the labor market, however, continuous claims for the week ended 1/24/25 were revised upwards, notching above 1.9 for the first time in 36 months.

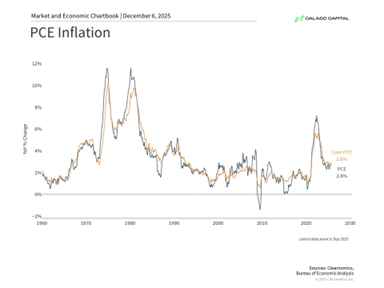

The Fed maintained rates steady as widely expected, and even though it did not share its projections (next release expected for March’s meeting), the somewhat hawkish tone did not help market sentiment. Based on the announcement and subsequent statements during the press conference, monetary policy is shifting from preemptive to reactive with data dependency once again in focus. The FOMC was unanimous in its decisions to keep interest rates steady and cited strong macroeconomics in the US together with a balanced labor market (allowing it to focus solely on inflation). Despite acknowledging that the Fed fund rate was “meaningfully” above neutral, they expressed no rush to cut them soon to address it. Hence, given the continued runoff of the Fed’s balance sheet (i.e., a deliberate measure to reduce its balance sheet) arguably policy will remain somewhat restrictive and keep rates along the yield curve elevated with some market participants expecting long-term yields to rise in the near term. Fiscal policy measures, specifically tariffs, may yet add additional pressures on inflation in the US that remain elevated and have yet to gravitate towards the Fed’s defined target. One thing the Fed will not do is to discuss or consider deviating from its goal of price stability, or 2% inflation year-over-year.

This upcoming week will have a slew of US macroeconomics reports, with focus following the Fed’s meeting, naturally falling on the labor market related data. Tuesday kicks off with the job opening report for December (JOLTS), followed by the non-farm payroll report on Friday for the same month. On Thursday, the markets await the usual weekly report on initial and continuing jobless claims.

Elsewhere in the world, the ECB did cut rates by twenty-five (25) basis points as disinflation in the Euro-Zone progressed somewhat, even though inflation in German remained elevated at 2.8% as reported on Friday. Notwithstanding, an update on Euro-Zone consumer prices is expected for Monday that may support ECB’s monetary policy towards neutral or easing from restrictive. Concerns do remain, however, with service prices still showing significant inflationary pressures, all the while growth in the Euro area appears to stagnate. Tariffs by the US may exacerbate the growth concerns.

Latest Newsletter

Week in review and ahead (vol.49)

marketing@caladocapital.com2025-12-06T21:55:55+00:00December 6, 2025|

Week in review and ahead (vol.48)

marketing@caladocapital.com2025-11-29T23:35:08+00:00November 29, 2025|

Week in review and ahead (vol.47)

marketing@caladocapital.com2025-11-22T23:56:30+00:00November 22, 2025|